tax preparation fees 2020 california

According to the National Society of Accountants 20182019 Income and Fees Survey the average tax. The Calculator gives you useful information to determine fees for the various tax.

The short answer is.

. Do Your 2021 2020 any past year return online Past Tax Free to Try. The average cost for a. Individual Nonresident Income Tax Return.

Form 1040X Amended Tax Return Originally Prepared by Taxlana Inc 20000. How much might it cost to have a professional prepare your tax returns. Easy Fast Secure.

Are Investment Fees Deductible In California 2020. 20202021 Federal and California Tax Update Practitioner Aids 2020 Spidell Publishing Inc. NSA conducts a periodic survey of members to gauge the average cost of preparing many types of tax.

Ad Browse discover thousands of brands. Easy Fast Secure. Free shipping on qualified orders.

Our tax preparation fees for most individual tax returns is 500 to 700 and corporate tax preparation is generally 800 to 1000. Certain mortgage interest or points above the limits on a federal return. NSA has made the Tax Preparation Fee Calculator available as one of its valuable benefits of membership.

Personal casualty or theft losses. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. 2020-2021 Income and Fees of Accountants and Tax Preparers in Public Practice.

As of June 18 2021 the internet website of the. References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the. Read customer reviews find best sellers.

In this report weve broken down national and state averages for both individual and business tax returns so you can see. File Make a Payment. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in.

Form 1040NR US. Free easy returns on millions of items. Preparation fees are based on major schedules and forms used to complete the tax return electronic filing included.

The slightly longer answer is that the cost to file your taxes with a tax pro will vary based on a wide range of factors. Federal 1040 and California 540 individual tax preparation starts. 2020 Instructions for Form 568 Limited Liability Company Return of Income.

Enter your income from. California allows deductions for tax preparation fees. Schedule A Itemized.

Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR. Ad Find Recommended California Tax Accountants Fast Free on Bark. File a return or make a payment online by logging into our secure site using your username and password.

State Corporate Income Tax Rates And Brackets Tax Foundation

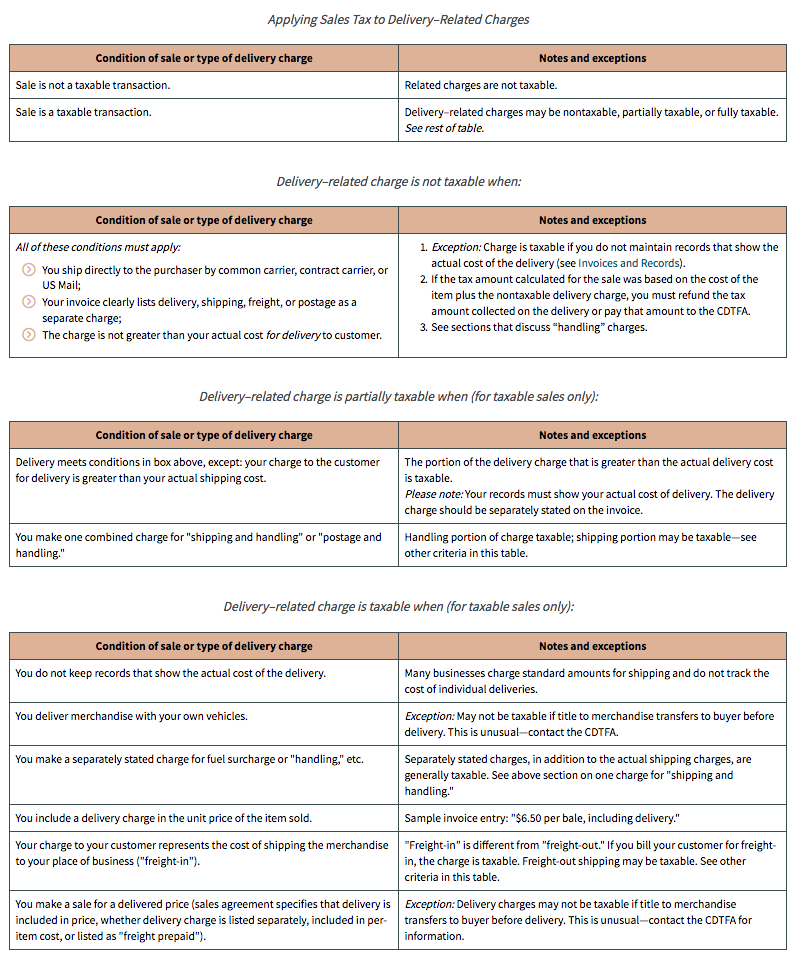

Is Shipping In California Taxable Taxjar

Californiataxtable Income Tax Brackets Tax Brackets Tax Prep

What Are Marriage Penalties And Bonuses Tax Policy Center

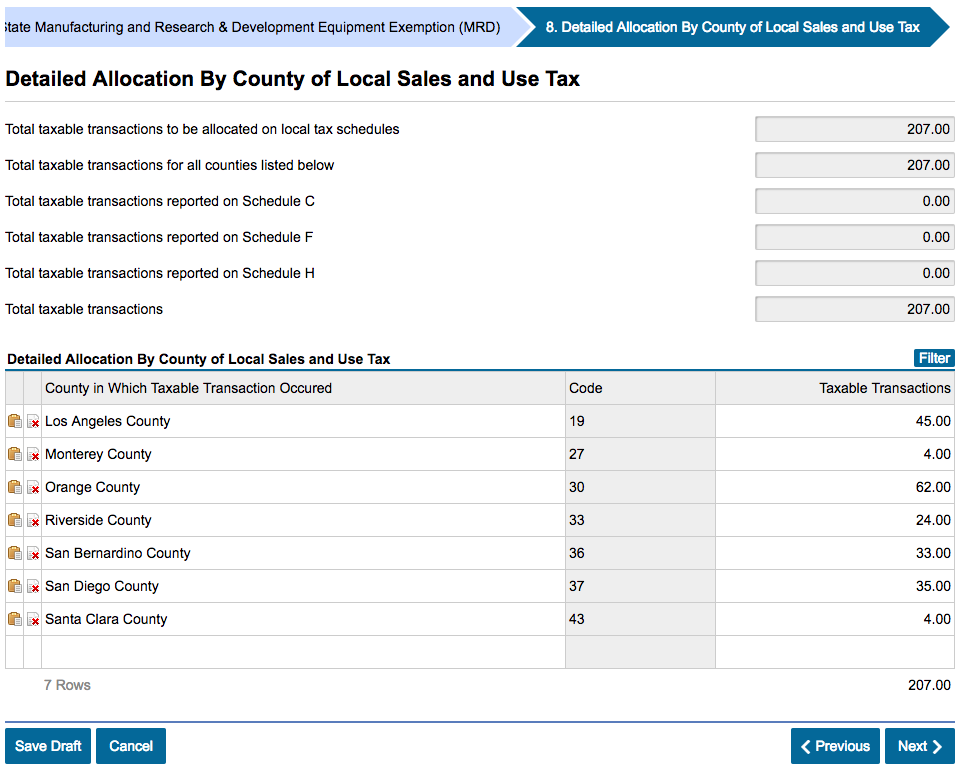

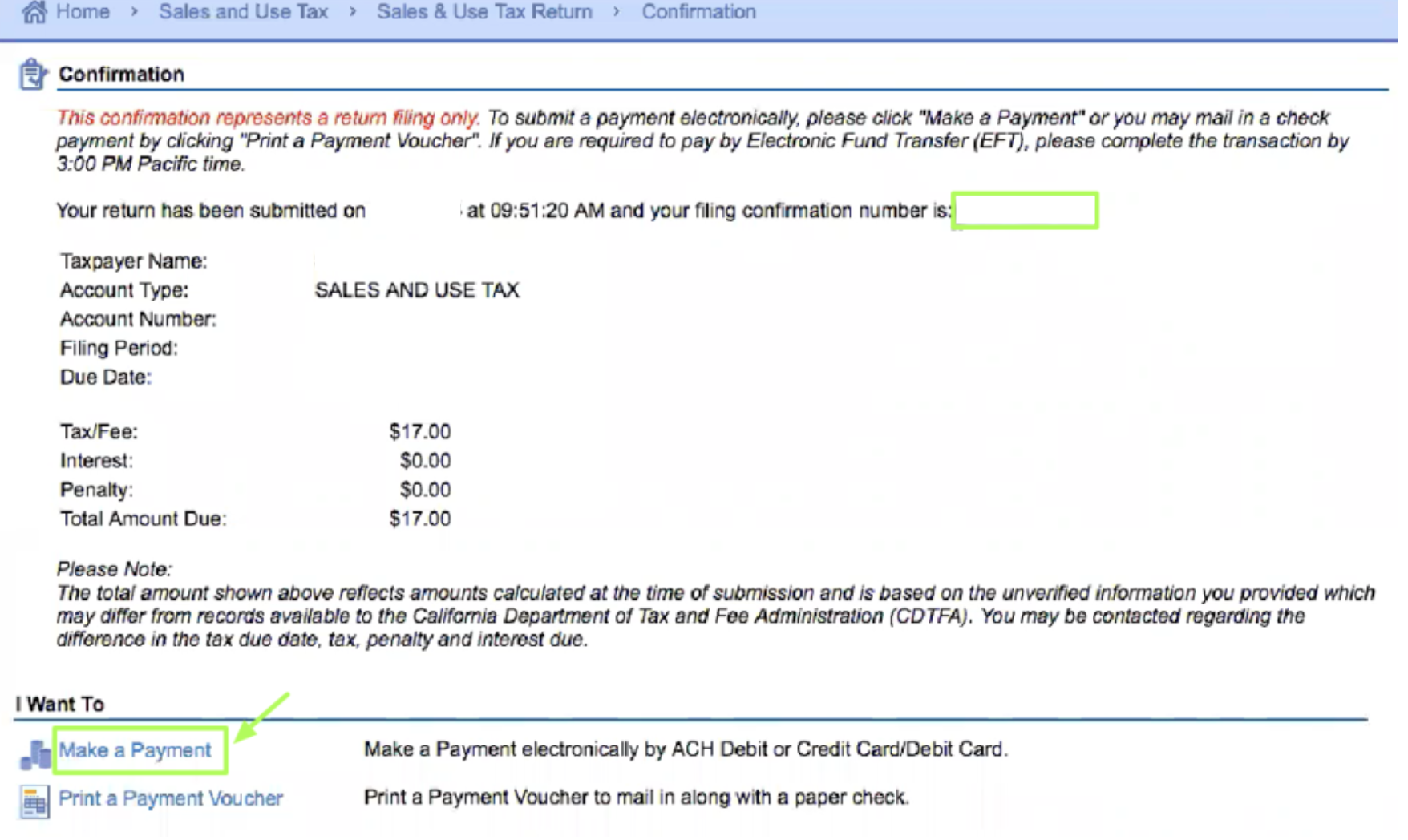

How To File A California Sales Tax Return Taxjar

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

California Used Car Sales Tax Fees 2020 Everquote

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Vendor Invoice Template For California Invoice Template Invoice Design Template Invoice Template Word

New Rules For Property Tax Transfers In California Realty Times Tax Services Income Tax Filing Taxes

How To File A California Sales Tax Return Taxjar

How To File A California Sales Tax Return Taxjar

How To File A California Sales Tax Return Taxjar

Still Life Photography Workshop And Retreat Life Exposed Still Life Photography Life Photography Photography Workshops

2020 1099 Misc Irs Copy A Form Print Template Pdf Fillable Etsy Print Buttons Print Templates Irs